Most senior finance leaders ask, “Why would I want to move financial planning and analysis (FP&A) work to shared services when the work is so essential to the success of the business?” True, FP&A is crucial to the business – but like all functions, it can be streamlined to achieve even better results.

There are a couple of responses to the question of whether moving FP&A to shared services is a good idea:

- The work moving to a scaled FP&A organization has little to do with the real business analysis or decision-making. The work that will move is what is already manually done today, typically inefficiently, and definitely does not improve business decision-making.

- The move of transactional work away from the business actually improves results. This is attributed to the fact the business can focus externally on competition and growth building activities versus internally on highly technical and transactional FP&A tasks.

The creation of FP&A shared services provides significant benefits to a company. It enables more effective and efficient creation of the technical financial planning process. This is the direct result of focusing resources only on the technical tasks. At the same time, the FP&A resources remaining in the business centers are able to focus on analysis and insights to grow the business.

The closest comparison to FP&A technical work moving to shared services is related to the accounting profession. The creation of globally scaled organizational design in accounting has been going on for three decades.

Background

In the past 30 years, accounting has transitioned from local accounting completed by accountants booking entries from the city country, or region of the world where they live and work, to local accounting completed by accountants sitting in regional service centers booking entries for legal entities somewhere in the world. Many times, the accountant has never even visited the country where the legal entity is domiciled; he/ she is simply handling transactional accounting for their company in the most cost effective and efficient manner possible.

How has this been possible? Professor Gary A. Giroux of Texas A&M University has a keen interest in accounting history and frequently writes about the rapid development of technology, which has allowed for the monumental change in accounting. Through technology, accountants can now sit in any location in the world. They can communicate and transact accounting through the use of technology (like SAP, Oracle, etc.) with any sales office, regional headquarters or global headquarters of their company. However, technology only partly explains this change. There are other enablers required for technology to facilitate this approach to accounting, including:

- Centralized organizational design

- Globally standard work processes

- Globally standard policy

Convincing Arguments – Now What At Are The Thee Options?

If the similarities between accounting and FP&A are accepted, it is not difficult to imagine a future where FP&A transactional activities occur in a centralized organization located onshore or offshore in shared services or outsourced.

There are a number of organizational design decisions that need to be made prior to moving into shared services.

The initial decision is related to whether to outsource or insource the work. Although this should be a relatively value-driven discussion it typically becomes more of a company culture choice. To avoid the inevitable politics of this choice, a request for proposal process that pits the creation of an internal shared service organization versus outsourced is recommended. At a minimum, there will be financial data to support the decision.

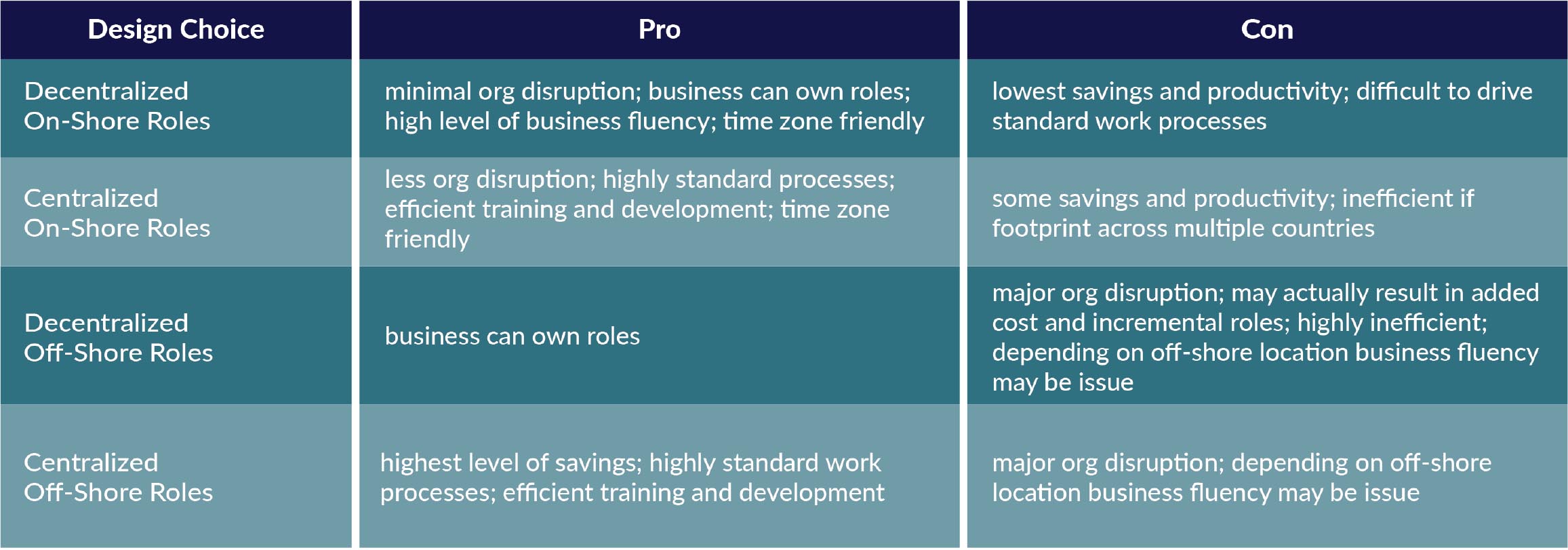

Once the decision to outsource or insource is made, there are a number of centralized or decentralized and onshore or offshore options to assess, as outlined below. These options need to be assessed versus the respective company culture and overall global footprint. However, the pros and cons outlined above should give some guidelines to help in the assessment process.

Setting Up Shared Services

For discussion purposes, assume a company decides to set up a centralized, offshore shared services location. There are two different organizational designs related to this: front and back office.

Front office key design elements:

- This organization is responsible to interact directly with the ‘center of expertise’ or the end users.

- This organization owns direct interaction with the back office – the organization that owns the collection of inputs, processing of data and sending out final reporting or analytical data.

- These roles require a number of skills that may be difficult to develop in the typical shared services. Extended business trips, travel to the business centers, or some combinations are often required to build the right level of expertise.

- These roles must be adept at the systems or tools, understand the end-to-end work process, have a working knowledge of the business, be able to participate in business process changes, and communicate clearly and concisely with the business resources.

- These roles will typically be located in a service center that is in a time zone-friendly location for easy communication with the end users.

Back office key design elements:

- This organization is responsible for interacting directly with the front office. In some specific ‘rule-based’ activities they interact directly with an end user.

- This organization owns the collection of inputs, processing of data and sending out final reporting or analytical data.

- These roles require specific skills that may be difficult to develop in typical shared services. However, it is possible to leverage the setup of the front office to develop and train the back office. (“Train the Trainer” concept: Front office is trained on the ground, in the business location, and goes back to the service center location to train the back office.)

- These roles are the key experts on the systems or tools, understand the detailed workings of the end-to-end work process, have a limited knowledge of the business, have an ability to participate in system or tool testing, and communicate clearly and concisely with front office on technical issues.

- Roles are located in a service centre; time zone is less critical since they interact directly with the front office. In most situations, the back office can be consolidated into one location around the globe. This may require the use of double shifts in some locations.

Unfortunately, there is further end-to-end organizational design required to best operate a shared service structure.

About SynFiny Advisors

We value experience. Our advisors leverage decades of Fortune 50 experience in financial planning & analysis and shared services design and operations to deliver breakthrough solutions for our clients. This collective experience has been distilled into a proprietary consulting methodology that enables our advisors to quickly apply their experience to the specific objectives of our clients, leading to faster and longer lasting value creation.

For more information, please visit synfiny.com.