This is the second in a series of articles that explore how to justify, plan and execute FP&A transformation. In the first article, we discussed how to justify a transformation project. In this article, we’ll look at how FP&A transformation delivers real, measurable value to the firm.

According to the most-respected international association of accountants and financial professionals, the US Institute of Management Accounting, when the right infrastructure is in place for an organization to use FP&A in an unbiased manner, FP&A can “provide consistent, reliable, relevant, and meaningful information.”* Yet, in most companies, the FP&A process tends to be non-standard, and executed with minimal planning, coordination or standard methodologies. This lack of a strong infrastructure surrounding FP&A leads to inaccuracy, ineffectiveness and inefficiency.

However, by intentionally developing and rolling out a synchronized financial planning process, your organization can quickly deliver best-inclass value

The SynFiny Advisors’ Definition of FP&A

- Critical value creation processes, which require a deep understanding of finance, modeling, data systems and processes, and accounting, all married to deep business knowledge.

- Typically combines financial and nonfinancial data as required to create strategic and operational financial plans.

- When done well, these processes are a clear competitive advantage and thus are viewed as critical by a firm’s owners and senior leaders.

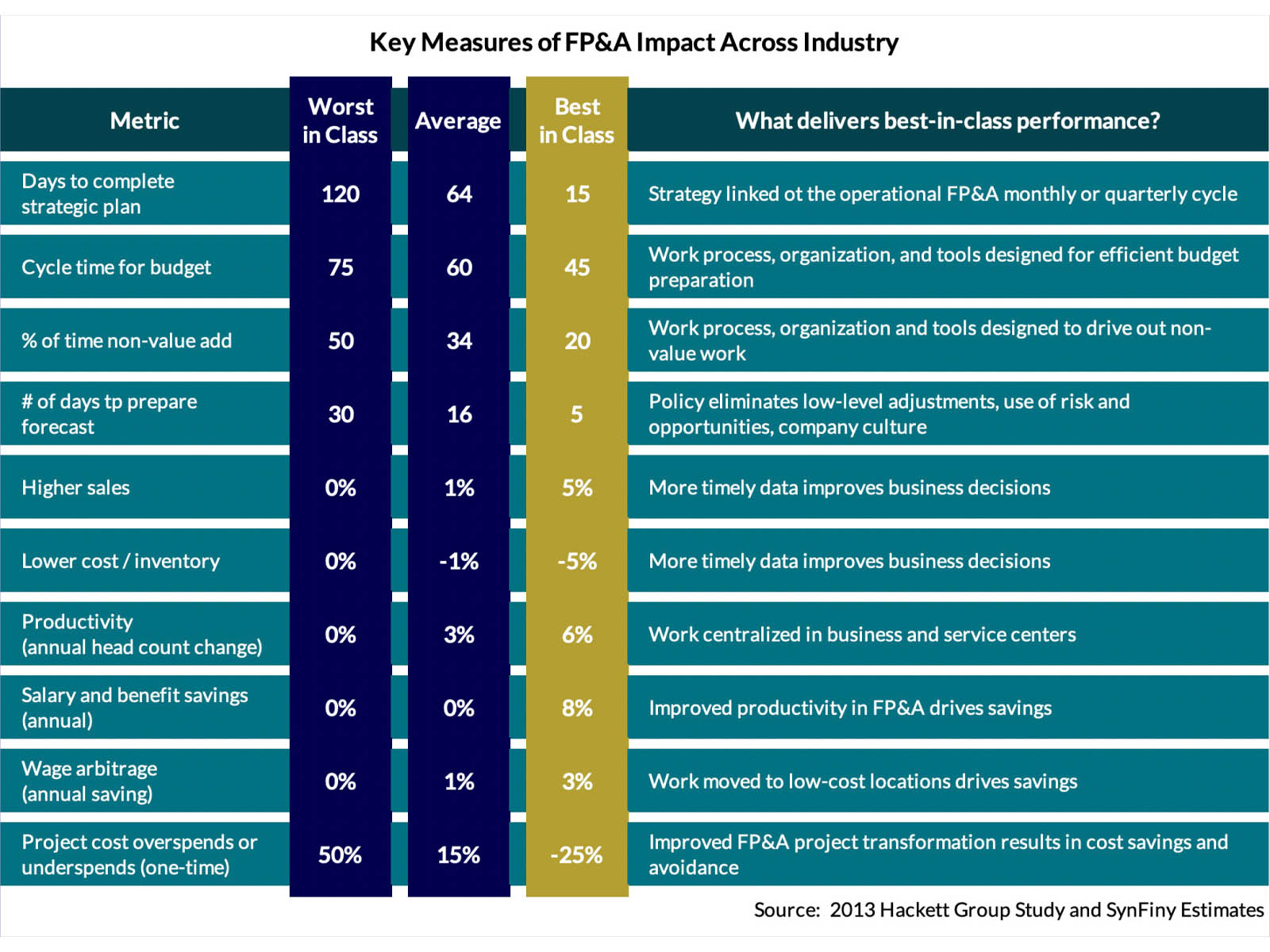

Measures FP&A can Improve

As your organization plans FP&A transformation, consider the following key metrics used to determine how well financial planning, budgeting and analysis tasks currently function. We’ve pulled this list from both industry reports (e.g., Hackett, American Management Association) and our own client experience. If your company’s current metrics fall below best-in-class in any of the metrics in this table, implementing FP&A transformation could bring significant value to your bottom line.

*2014 article at Association of Financial Professionals: https://gtnews.afponline.org/

What value can FP&A transformation bring to an organization?

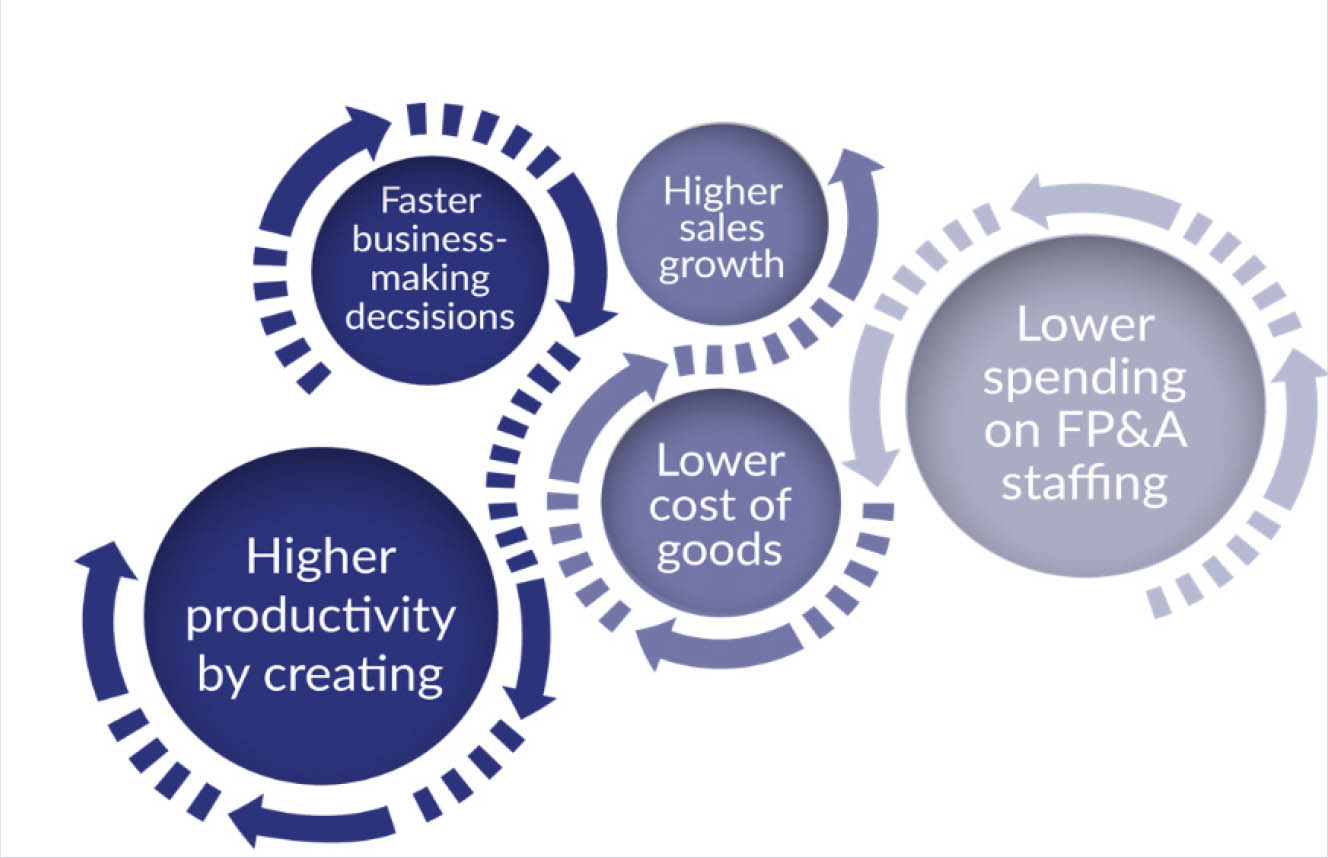

FP&A can bring your company a variety of benefits:

- Higher productivity by reducing spending on FP&A staffing

- Faster and more confident decision-making can deliver sales growth

- Identification of systematic ways to lower cost of goods

- Optimize inventory levels and free up working capital

The building blocks of FP&A value come from many different elements, not simply the impact of improved productivity or better cost management. The value comes across the income statement and balance sheet. It’s both human and dollars and cents.

For example, FP&A allows a company to link financial strategies with operational goals, which benefits several areas:

- Productivity (+15% to +30%): Centralizing the process for forecasting, budgeting and analysis produces a significant benefit in productivity.

- Increased sales (+1 to 5%): Giving business teams more timely and accurate customer demand data, fulfilment and sales results allow them to make better decisions.

- Decreased costs of goods or inventory (-1% to -5%): Business teams get better data on inventory, supply, demand and costs helping them optimize all these factors.

- Salary and benefits savings (-15% to -30%): Centralizing the work improves productivity.

- Potential wage arbitrage savings (-20% to -30%): Redesigning the finance organization to better assign “business knowledge” and “technical” tasks can allow the firm to shift technical F&A work to lower-cost locations.

Other benefits can also accrue, including:

- Improved data cycle time (< 50%): Reporting cycle time can often be cut in half, giving better data to business teams faster.

- More timely and visible data (2x faster): Better and faster data, provided with more understanding supports faster business decision-making.

- More reliable and sustainable forecast accuracy: Clearer and better FP&A work processes enables better and more accurate forecasts.

- Improved stewardship: Better financial plans are more transparent and better understood by decision makers and stakeholders, helping reduce forecast or budget surprises that could create control issues.

The bottom line is transforming FP&A can truly help your bottom line. With more timely and accurate data, your business can better understand and act on operational opportunities, from capturing new sales to achieving lower costs. Improved forecasts and data reporting also help companies better understand and manage adversity. For instance, reducing the impact of customer financial problems, adjusting to commodity price swings or addressing currency exchange issues.

FP&A Transformation makes for better finance and accounting organizations!

In addition to bottom line benefits, an FP&A transformation effort allows firms to deeply examine and clean-up work processes. Tasks and transactions that have “always been that way” get a needed review. Inefficient and ineffective work processes that have been baked into the organization for some time get their turn under the microscope.

Cleaning out these procedural cobwebs and getting to common, well documented and designed tasks and processes unlock FP&A’s bottom line impact. They also help the finance team spend more time on higher value analytical support and improvement work.

Firms, large and small, are getting behind FP&A transformation

Across industry, better and more standard financial planning processes are emerging. The American Productivity and Quality Center (APQC) has published FP&A capability white papers from US companies as diverse as Mutual of Omaha, Discovery Communications, Infosys Ltd., UnderArmor, AT&T, Clarient Inc., and Intel.

Importantly, transforming FP&A does not have to be a costly or intrusive systems projects. There may be simple and cost-effective options for implementing FP&A transformation. Future articles will look at some of these options in more detail.

If you believe your company could benefit from improved productivity and streamlined financial processes, the advisors at Synfiny Advisors can help.

You can find out more about us at synfiny.com