The Importance of FP&A Work Process & Design

The key building blocks of any successful Financial Planning and Analysis (FP&A) end-to-end work process design is the creation of the future state process, alignment with C-level leaders to ownership over key steps in the process, and eventual roll out and implementation of the new work process to the broader organization.

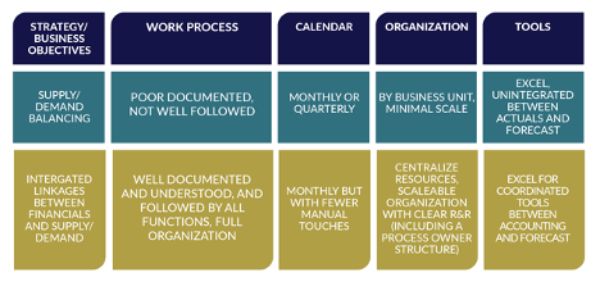

The most effective and efficient FP&A end-to- end work process design is well synchronized and closely coordinated between the organizations doing the work, the system supporting the work, and the policy guiding the work.

The end result of a fully synchronized FP&A work process delivers best in class performance versus a company’s key competitors. More importantly, it ensures a company meets the long-term financial commitments to key stakeholders.

Net, the FP&A work processes tend to be a critical priority for C-level leadership.

The SynFiny Advisors’ Definition of FP&A

- Critical value creation processes, which require a deep understanding of finance, modeling, data systems and processes, and accounting, all married to deep business knowledge.

- Typically combines financial and non-financial data as required to create strategic and operational financial plans.

- When done well, these processes are a clear competitive advantage and thus are viewed as critical by a firm’s owners and senior leaders.

A Definition of Financial Planning & Analysis Work Process

Before delving deeper into FP&A work process, it is necessary to get grounded on the definition and full ownership and scope of the FP&A organization.

SynFiny Advisors defines FP&A work process as:

“The critical value creation processes, which requires a deep understanding of business fluency, finance, modeling, data systems and processes, and accounting. This typically combines financial and non-financial data as required to create strategic and operational financial plans. When done well, these processes are a clear competitive advantage and enable the delivery of long term financial commitments, thus are viewed as critical to C-Level Leadership.”

There are a number of critical company processes, which most FP&A teams fully own (or provide oversight leadership):

- Strategic Planning – The development of the mid to long-term financial plans which support the overall strategic plans of the company. It is critical FP&A owns the strategic financial plans since the plans need to be closely linked to the short term operational financial plans.

- Budgeting – Budget management and control is essential to penetrating and understanding the SG&A, marketing, or other budget- related spending by a company. This includes aligning the initial budget creation with the overall strategic and operational financial plans of the company.

- Forecasting – The forecasting management and related control provides a reasonable but challenging profit, cost, or other P/L items forecast to senior leadership and business teams. The forecast may be required for a combination of internal and external use. This includes reconciling and explaining the forecast in regards to the overall strategic financial plan of the company.

- Management Reporting – The creation of reports, which are easy to understand and use by senior leadership to visualize the dynamics of the business. The reports provide insight to the business (versus just sharing data). A useful report from FP&A is created with a “single number truth” mentality across functions to avoid debates on the numbers.

- Financial Analysis – The translation of data into insights so business teams can make the right decisions, at the right time, and with the right level of understanding. This in turn translates into a key competitive advantage for the company.

- Capital Planning – The process for determining the right level of capital investments into the business based on the overall financial strategy.

- Business Modeling (e.g., New Ventures and Investments) – The linkage of business modeling into the overall financial strategy and planning process for the business. This may be an externally driven acquisition, divestiture, or internally restructuring of a business.

Of course, the processes above typically require other functions in the company to play a critical role. However, finance needs to play an overall leadership role given the importance of the FP&A processes in delivering both stewardship requirements and financial strategy commitments of a company.

The Importance of FP&A Work Process

The two areas of FP&A design that require the greatest focus are company culture and work process.

The rationale for highlighting these two areas is they both tend to create the majority of the financial planning issues when they are done incorrectly. Below is just one example of many potential issues from each area:

- Company Culture – In many companies, there is a tendency to manage to a target (basis for gaining management commitment to financial expectations) versus providing a realistic update to a forecast (basis for understanding current state of the business and related approved investment plans). This cultural tendency leads to managing against a single number forecast (and creates the need to “plug the forecast” to ensure what is communicated to senior management is the “right number”). In many cases this tendency to deliver a specific “right number” versus updating the forecast based on business realities creates catastrophic forecast misses for a company. The separation of the target and forecast is typically one of the first changes required to improve overall FP&A for a company.

- Work Process – For work process, there is a tendency for the C-level and senior finance leaders to think of FP&A work processes as a simplistic start and end date. The forecast, budget or analysis begins on any day of the month and then ends sometime in the future without regard for the critical steps in between. This overly simplified two-step work process is part of the reason FP&A data tends to be seen as a “black hole” since there is little transparency to the detailed steps required to transform “data in the raw used by accounting” into “data fit for use by the business.” The data is then further transformed or penetrated to provide deeper insights onto the status of the business. These insights may then be used to drive improved business decisions and can result in greater levels of sales growth or cost reductions.

Unfortunately, instead of focusing on the real issues, most companies immediately look to replace costly systems when a financial planning issue arises versus focusing on the real root causes. The root cause typically has little to do with the systems and more to do with a work process, organization design, or company culture. This position paper is focused on end- to-end process – but remember, organization and company culture also impact FP&A design work.

FP&A End-to-End Design

– Current to Future State

There tends to be a common belief in finance organizations that work process does not apply to their work with justifications such as: “A detailed work process may be fine for accounting or manufacturing but finance work is much more of an intellectual, flexible and mostly un-planned activity. There is no need to develop work processes around FP&A since it will only reduce intellectual freedom and management flexibility.” This line of thinking usually runs from the CFO down to the lowest levels of the organization.

To be fair, there is merit to the arguments made by finance leaders since the forecasting, budgeting and analysis processes are mostly art and some science. The intent of the FP&A work process redesign effort is to keep the best parts of the current finance planning process but add to it the rigor of a structured and better planned end-to- end work process.

There are large, companies spending billions and billions of dollars, which have little more than a word-of-mouth process when it comes to budgeting or forecasting. This does not imply forecast or budget controls are not in place, though at times this may expose a company to stewardship issues. But there is clearly an opportunity to drive efficiency and effectiveness in the financial planning process by driving more structured FP&A process planning.

The next process flows are simple examples of a pre- and post-FP&A work process redesign.

FP&A End-to-End Design – Current to Future State

Pre-FP&A Work Process Design

Post-FP&A Work Process Design

This is a relatively simplistic example of a work process related to requesting, approving and managing of a marketing budget. There are only nine steps in this work process, so it seems quite impossible to make this more efficient or effective. However, at least four of these nine steps need to be challenged and potentially eliminated or redesigned.

After a deeper exploration and understanding of this work process, there are a number of step changes and improvements to the current process. These changes eliminate 33% of the steps and make the process significantly more efficient.

The following changes can be made to this work process:

- Approval of Internal Orders – The internal orders are master data fields in SAP that are used to collect event level spending in SAP. For some reason, finance approved the creation of internal orders. Finance leaders approved the internal orders because “they always did it this way.” If management does not know why they are doing something it is easy to eliminate the step.

- Finance Sent Actuals to Marketing – The roles and responsibilities are unclear between finance and marketing. Finance was playing a report generation function versus providing marketing return on investment analysis to the business. An automated report tool could be developed to send the actual data to marketing.

- Marketing Sent Budgets to Finance and Finance Requesting More Funding – Finance believed their role was to both collect the budget updates and communicate the new budget requests during budget meetings. This work could be best done by the marketing function.

There was incremental work added to finance. The finance team was asked to provide more comprehensive marketing event return on investment (ROI) analysis. However, the benefit of greater marketing event analysis far outweighs the additional effort (and the organization was more motivated).

The Benefits of Redesigning FP&A Work Processes

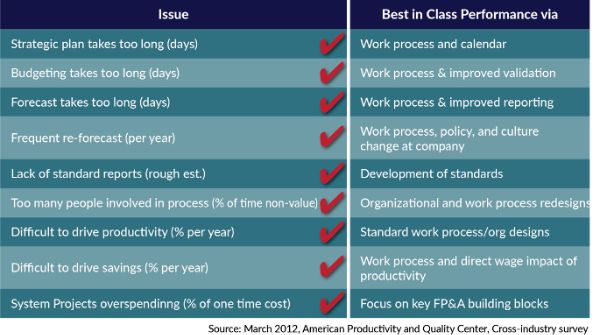

The following chart shows the most mentioned FP&A work process issues mentioned by senior finance leaders during an American Productivity and Quality Center (APQC) survey from March 2012.

FP&A Work Process Redesign Addresses “8 of 9” Issues

The issues mentioned in the APQC study are consistent with the issues seen across most companies and industries today. Jeffrey Wuest, managing partner of SynFiny Advisors, confirmed during a recent APQC Finance Management webinar (10 Dec 2014, https://lnkd.in/ecWsvqp) that he has seen “similar FP&A process issues while working on transforming Procter and Gamble processes and other clients over the past couple decades.”

The redesign of the FP&A work process creates a number of key benefits:

-

- Stewardship – The combination of reduced cycle time and increasing visibility of the financial plans will inevitably drive improved stewardship. Of course, this needs to be combined with the creation of policy, which is synchronized with the work process.

- Spend Less or Avoid Overspending on Projects – When work process is combined with tool and organization design, the project has a much greater chance of success. Thus, projects will not overspend.

- Deliver Higher Productivity – The elimination of unneeded work process steps will drive increased productivity or—when combined with organizational redesign—can create center of expertise capability in the technical financial planning creation. This can enable productivity in excess of industry standards from 1% to 3%.

- Deliver Higher Quality – By creating more visibility to the work process, the providers of the key inputs will have better understanding of the use of their data. This will drive a higher level of quality in the data (or at least, provide more visibility to steps in the future). This increased visibility to the process will allow for data-based discussions with those functions whom provide low quality inputs to the process.

- Improved Business Decisions – The elimination of unneeded steps in the process, causing greater visibility to input and output of data, and creation of expertise within all functions data will be easier to understand and utilize. Instead of simply sharing data, it will allow for sharing insights about the data, which provides improved business decision-making.

These benefits are a direct result of focusing on broader and deeper end-to-end FP&A work process redesign efforts. For most companies, the benefits will by far outweigh the cost and efforts of the FP&A process redesign.

About SynFiny Advisors

We value experience. Our advisors leverage decades of Fortune 50 experience in financial planning & analysis and shared services design and operations to deliver breakthrough solutions for our clients. This collective experience has been distilled into a proprietary consulting methodology that enables our advisors to quickly apply their experience to the specific objectives of our clients, leading to faster and longer lasting value creation.

For more information, please visit synfiny.com.