How to Design the Optimal FP&A Organization

There is no company which can run systems, follow work processes, or implement policy without a fully trained and well-designed organization. Unfortunately, many times this is one of the most overlooked (after work process) areas of FP&A design.

There is no company which can run systems, follow work processes, or implement policy without a fully trained and well-designed organization. Unfortunately, many times this is one of the most overlooked (after work process) areas of FP&A design.

- The arguments for overlooking a well thought out organizational design are: The current organization can do the work if the CFO tells them to do it. It is merely a command from leadership, which will get the organization to jump into the new work process or tools.

- The design of the organization does not have much to do with tools or work process. There is no need to make substantial changes to the way the finance or other functions are designed. The functional leaders will request tools and work processes are designed around the organization.

- It is easy to change tools or work process. If you make changes to organization, it will be too difficult and will risk a successful implementation.

The SynFiny Advisors’ Definition of FP&A

- Critical value creation processes, which require a deep understanding of finance, modeling, data systems and processes, and accounting, all married to deep business knowledge.

- Typically combines financial and non- financial data as required to create strategic and operational financial plans.

- When done well, these processes are a clear competitive advantage and thus are viewed as critical by a firm’s owners and senior leaders.

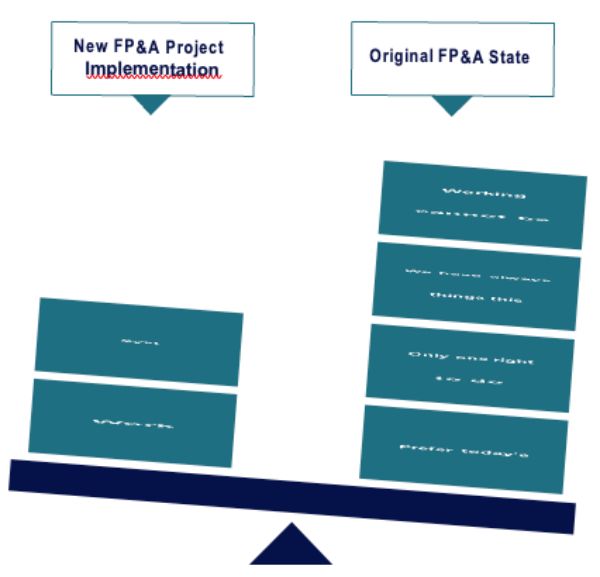

Unfortunately, these arguments tend to put the organization in a no win situation. In the best case, the organization is able to use the tools or follow the work process but never leverage to create a step change in financial planning. In the worst case, new the tools or work process become parallel to the prior ones causing, rework and distraction for the entire organization. In most situations, the projects need to be re- implemented to fix the outages, which distract the organization, drive significant project costs, and typically result in a sub-optimal financial planning design.

Background

In his seminal 1992 work entitled Organizational Culture and Leadership, Edgar H. Schein, Professor Emeritus in the Sloan School of Management at MIT, defined “organizational culture” as “a pattern of shared basic assumptions that was learned by a group as it solved its problems of external adaptation and internal integration, that has worked well enough to be considered valid and, therefore, to be taught to new members as the correct way to perceive, think, and feel in relation to those problems”.

This definition helps explain why SynFiny focuses so heavily on organization when considering any type of financial planning redesign. Since organizations develop shared assumptions about the “correct and acceptable” way to complete any tasks, changes are open to rejection by the organization since they are seen as counter to the norm.

This resistance to adoption can manifest itself as an open revolt or a gradual reshaping of the change back to the original design leading to sub-optimized results from the FP&A project implementation.

It is for this reason organization is a key focus for FP&A transformation. The focus needs to be on culturally preparing the organization for change, while ensuring specific changes are implemented to create an effective and efficient FP&A design (driving adoption by the organization).

Work Process Design Begets Organizational Design

It is the definition and optimal design of who should do the work where most organizations fall short. Therefore, the first task is to document the FP&A work process so that you will clearly understand all activities required to complete a given outcome. These activities can now be regrouped to drive efficiency and effectiveness by assigning technical teams that own specific parts of the process as experts in those tasks.

To note, there are many AFP articles or papers written about creating or transforming FP&G work process. These documents will help to better explain how developing standard work process combined with the organization redesign will enable improved performance.

The chart below shows a high level FP&A- marketing budget work process. However, it also illustrates how best to segment the tasks into an improved organizational design.

In the organization design above, there are 4 main organizations responsible for the end-to- end work process.

The Leadership Team owns Orange tasks which relate to approval of marketing plans and budgets. These tasks should not be delegated to other organizations since the approval process triggers the entire work process. There is also an element of basic controls which requires key leaders to approve budget changes.

Marketing owns the Yellow tasks which relate to placing a purchase order, carrying out the marketing event and tracking their budget. These are focused on their business responsibilities or on the need to supply master data which only they know (e.g. requesting a purchase order).

Finance owns the Red tasks which relate to budget tracking, approvals and analysis. This allows Finance to truly play a leadership position by focusing on financial analysis to determine whether the investments optimize ROI and are aligned to the business strategy rather than collecting Marketing master data.

A Technical Team is available throughout the process to drive efficient and effective execution of the tasks.

What Does Technical Support Mean?

A Technical Team is a specialized group that is responsible for the handling of routine activities. As mentioned above, by documenting the work process the common activities can be regrouped. This regrouping process allows for these routine tasks to be identified and then scaled up by assigning them to a technical team who become very efficient and effective at them. While this step can be optional, it frees up capacity within leadership, marketing, or finance so these business leaders can focus on where they add the highest value.

The Path Forward… Assign FP&A Owner and Get Moving

Hopefully the examples above illustrate why the organization design is such a critical part of the overall creation or transformation of FP&A. The next steps are:

- Assign a FP&A project owner focused on organizational redesign

- Establish a working group from the FP&A team to better understand current culture issues holding back FP&A transformation

- Create an action plan to address the key cultural issues (may include working across business units or other functions)

- Develop the future FP&A organizational design (integrated with work process)

- Gain alignment within FP&A team and approval from C-level sponsors

- Reap the benefits of the transformation

Organization is important to the success of an FP&A process and by understanding it you can obtain better business and financial results.

About SynFiny Advisors

We value experience. Our advisors leverage decades of Fortune 50 experience in financial planning & analysis and shared services design and operations to deliver breakthrough solutions for our clients. This collective experience has been

distilled into a proprietary consulting methodology that enables our advisors to quickly apply their experience to the specific objectives of our clients, leading to faster and longer lasting value creation.

For more information, please visit synfiny.com.