Digital transformations are changing the ways that organizations do business. Strategic sourcing, order management, and payables have evolved from a functional exercise to a competitive advantage. And as organizations grow, so does the complexity of their supply chain, resulting in issues in the areas of decision making, compliance, and waste (monetary, time and potential materials). Leading Supply Management Organizations (SMO) are benefiting from improved innovation, faster speed to market, better cost optimization/value, more profit, increased productivity, improved cash flow, and better controls by implementing Source-to-Pay (S2P) strategies and technology-enabled automation into their procurement process.

Those new to S2P still face many challenges in the areas of supplier management, low-cost country sourcing, risk, compliance, etc. These organizations must maximize the benefits from the S2P model in the following ways:

- Thoroughly understand the needs and spending forecast of the business

- Extract the greatest possible value from regional and global supply markets

- Build collaborative relationships with high-performing, strategic suppliers

- Minimize supply risks

- Obtain collaborative and corrective behaviors from the people who spend

- Align strategy with business performance measures (e.g., cost of goods sold, working capital, cash flow, profit, shareholder value, market leadership and innovation)

Whether purchasing direct materials for manufacturing or indirect materials/services to support the finished product, a best-in-class SMO applies S2P strategies to all procurement decisions.

This translates to following key imperatives for S2P organizations:

Increasing Visibility: The most competitive S2P organizations are capable of connecting massive amounts of information and data from many sources, systems, locations, languages, and formats to create 360˚ visibility that supports a full range of strategic S2P activities (not just spend management).

Ensuring Compliance: Driving business performance means convincing employees to adopt preferred S2P processes, strategies, standards, and decisions. Compliance grows from a solution that combines aligned objectives, understanding risk, communication, collaboration, and consistent technology adoption.

Generating Savings: Minimizing costs/maximizing value can often feel at odds with other business objectives. S2P’s role is to make sure the results materialize in highly quantifiable ways. This could be hard savings to the bottom line or cost avoidance. This need had been poorly met from a S2P technology perspective, but the situation is improving rapidly.

What is Source to Pay (S2P)?

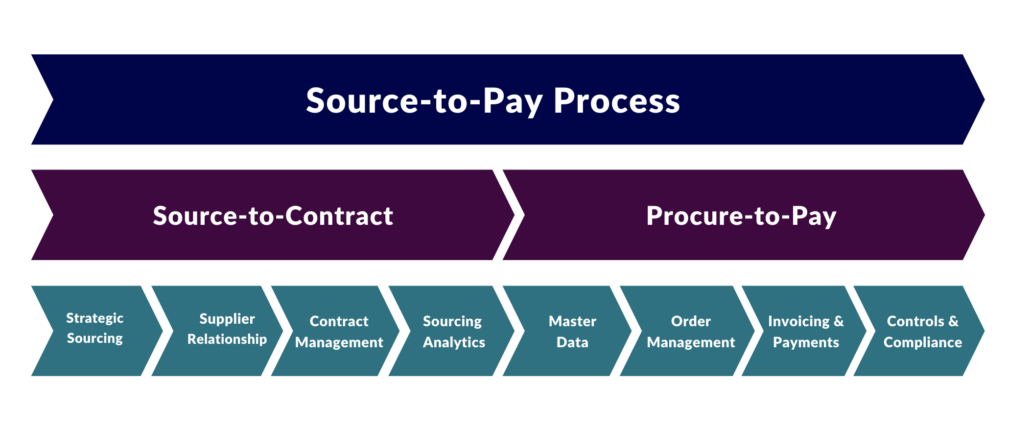

S2P is comprised of two distinct parts of the procurement process: Source-to-Contract (S2C) and Procure-to-Pay (P2P). S2C includes steps of assessing business needs, industry/supplier capability, economic analysis, strategy creation, strategy execution, and strategy renewal. On the other side, P2P covers the transactional flow of an order including collecting master data (e.g., supplier, material, pricing, etc.), order management, product or services payment, and compliance. S2P automation refers to using technology to streamline all or part of the S2P process.

Requisitioning: The “need” is generated in 2 ways: by automatic inventory/demand replenishment or by users that wish to purchase goods or services. Automation allows the users to plan or complete the requisitions electronically, often selecting items from a catalog that they are permitted to order from.

Requisition Approval: An approval policy should be in place, which may include no approval below certain dollar limits or manual approval by budget/functional owners. Once a requisition is raised, it follows the approval release policy before being converted to a purchase order (PO) and sent to the supplier. Manual approval processes have proven ineffective, as approvals are often not obtained or obtained after-the-fact due to time constraints. Automation allows for these requisitions to be routed electronically, following a decision (approval) authority matrix that ultimately reduces approval time. Most applications now allow approvals to be done from an email on a mobile device.

Issuance of Purchase Orders: Once a requisition is approved, a PO is issued to a supplier. Automation allows POs to be efficiently sent electronically with acknowledgments and proposed changes being returned electronically from the supplier.

Receiving Invoices: In traditional organizations, invoices are still mostly submitted by suppliers on paper via mail, then manually entered. In automated AP departments, invoices can be received electronically via email in PDF form, via e-invoice, or via a third-party network. Paper, PDF, and e-invoices can be swept up and scanned into the workflow using Intelligent Data Capture (IDC) and routed for goods receipt and or approval.

Matching Invoices: Once received, invoices should be matched to POs and receipts so that suppliers receive payments on time.

Issuing Payments: A combination of electronic payments, direct funds transfer, automatic bank account reconciliation, and Procurement cards (P-Card) are quickly increasing the volume of payments processed electronically. This steadily reduces the number of checks many organizations issue and reduces fraud risk and escheatment work.

Quantifying the Benefits of S2P

Hackett benchmarks suggest that a world-class S2P strategy will increase business results for companies by:

- Lowering PO process costs by nearly two-thirds

- Reducing order-to-pay cycle times

- Increasing payment-on-time to suppliers

- Increasing user and supplier satisfaction

- Doubling PO and Invoice management capacity for each FTE

- Reducing FTEs required to manage each billion dollars of indirect spend by half

- Increasing cash flow

- Converting Accounts Payable into a profit center

Reviewing each of these benefits in detail highlights the impact an S2P strategy can have on a business.

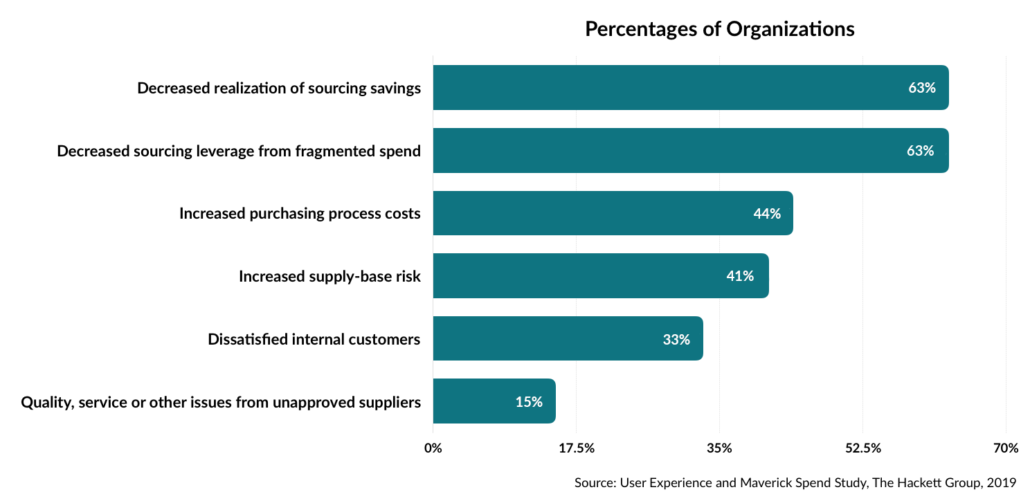

1. Impact on compliance

Best-in-class companies (91% + spend under management) with an implemented S2P solution show orders and spend are compliant with contracts, resulting in reduced maverick spending and minimized consequences from any maverick buying practices. Compliance policies drive users to the company’s purchasing channel of choice to ensure that the negotiated savings show up in the bottom line. For channel compliance and spend visibility, including assignment to the department or budget center where the spending resides is critical. Too often, senior executives want to insulate their organization from the need to comply and thus become the root cause behind why E-S2P, E-Invoice, and E-Pay policies do not work.

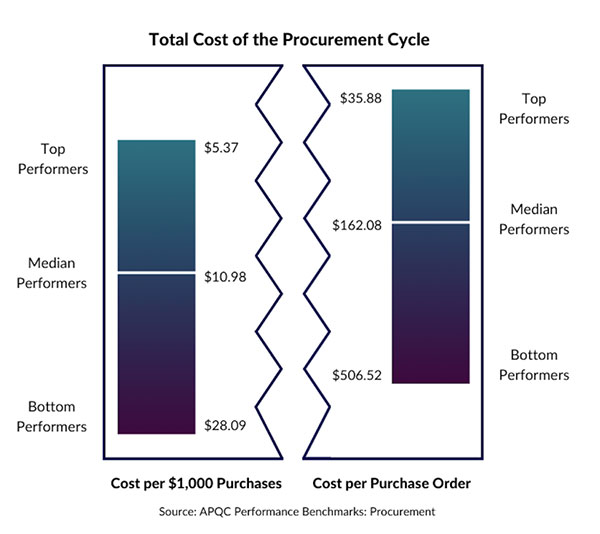

2. Impact on Transaction Processing

Manual PO processes are characterized by human errors, inaccuracies, and rework. Automating approvals, escalations and triggering events ensures that POs are expedited quickly. Furthermore, finding goods and services is easier when supplier catalogs and product information are available online and responsive to searches. APQC performance benchmarks show that S2P automation has a significant impact on the total cost resulting from procurement cycle time.

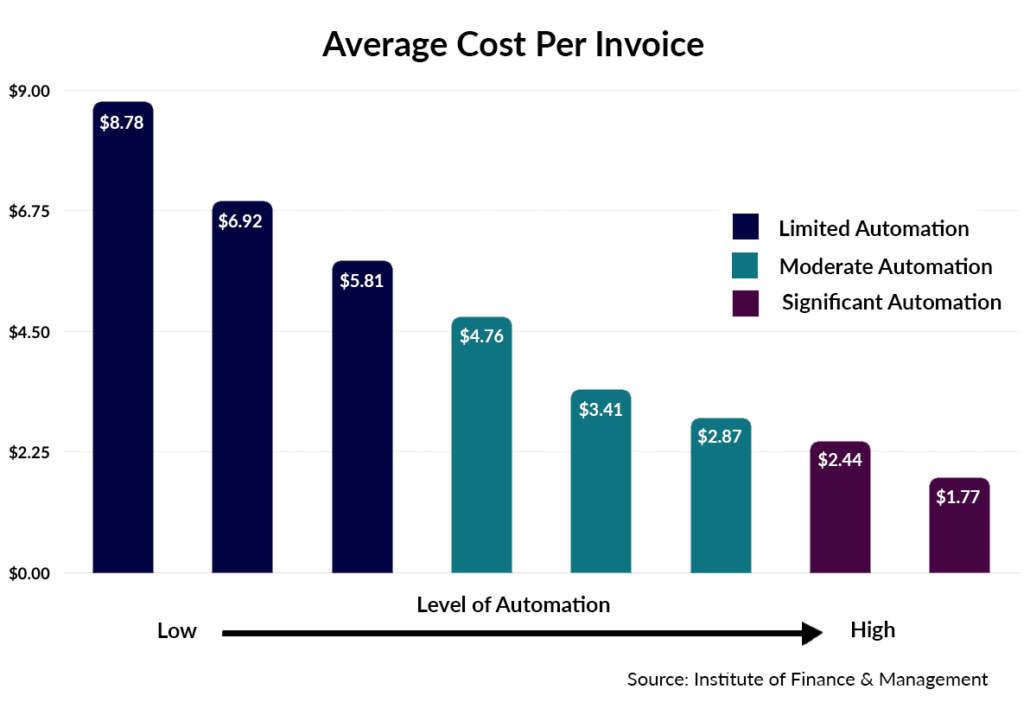

3. Impact on Transactional Processing Cost

Automation lowers transaction costs for PO and invoice processing, reducing the administrative overhead of the S2P organization. According to APQC and IOFM studies, organizations that implement e-invoicing and significant automation can realize a potential savings of 80% in processing cost per invoice.

4. Impact of S2P Automation on early payment discounts

While the use of e-payments is on the rise, companies are only capturing 19% of discounts offered to them by suppliers in return for early payment. Ardent Partners suggests that companies in the top quartile of performance, which adopt early payment discounts, realize discounting participation rates nearly four times as high as bottom quartile performers.

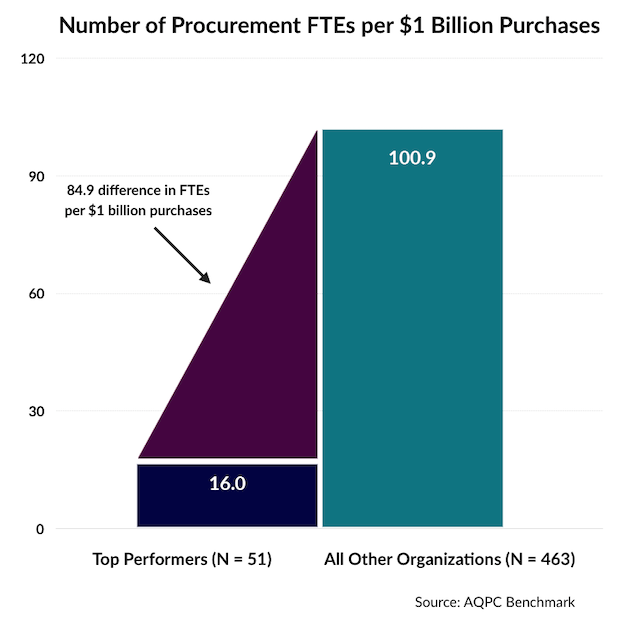

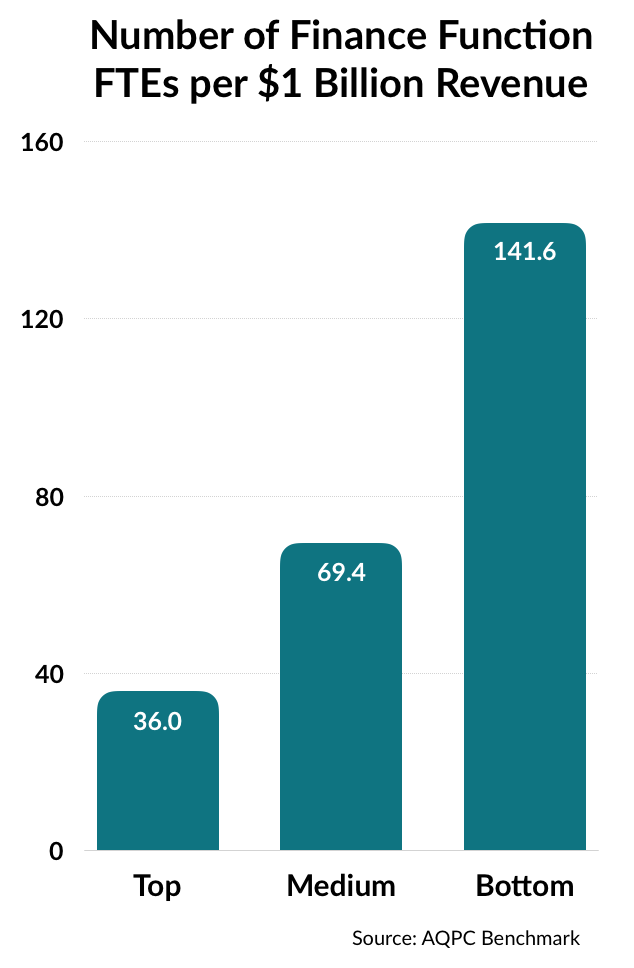

5. Impact on FTE

APQC says that a top-performing organization with implemented S2P solutions can operate with a headcount of 16 and 36 Finance/Accounts Payable FTEs per billion dollar spend respectively.

Creating a New Savings Wave – Linking

Creating a New Savings Wave – Linking

An S2P system may provide the monitoring and compliance checking capabilities without involving a spend analytics solution. However, spend analytics tools integrated with contract management and S2P systems can generally do much more sophisticated types of analysis, monitoring, and compliance checking. This increases efficiency, improves cash management, reduces inventory requirements, and slashes maverick spending. This often represents a process and prevented overpayment savings of 2-5% in many organizations, but the largest contribution of a properly implemented S2P system is a centralized, clean, data store that provides a solid foundation for spend analysis, which offers savings opportunities in the 5-15% range while enforcing the negotiated savings.

Conclusion

As companies across the globe are increasingly counting on Source-to-Pay strategies to deliver on savings, it’s imperative to not only develop a strategic outlook towards its supplier management initiatives but also to back its strategies by ensuring its savings initiatives are realized. By automating all or most of the components of the S2P process, organizations will increase visibility into its procurement process resulting in increased compliance and direct impact on the targeted savings.